san antonio tax rate property

Monday - Friday 745 am - 430 pm Central Time. Ad Look For Property Tax Bexar County Now.

Realtor Com Adds Home Value Estimates To Its Listings How To Find Out Home Values Local Real Estate

Public Sale of Property PDF Bidder Request Form PDF.

. Ad Make The Best Decision On Your First Home By Checking Tax Records Online. Visit Our Website Today. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country.

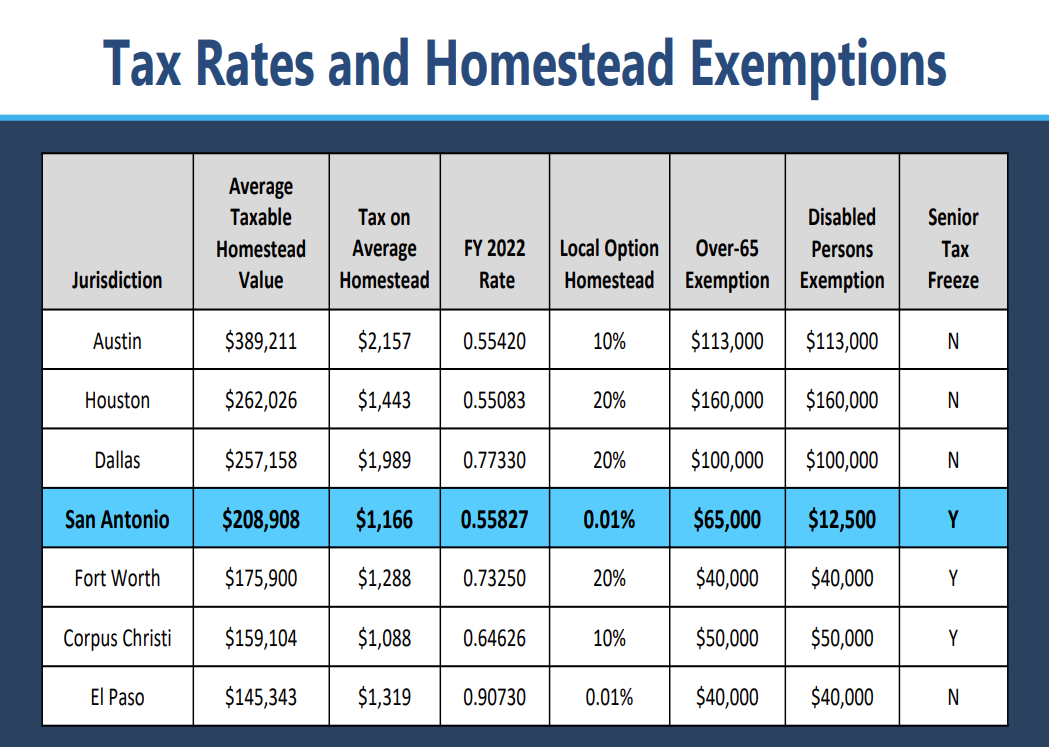

2 voted against the measure while Commissioners Trish DeBerry Pct. 33 rows San Antonio citiestowns property tax rates The following table provides 2017 the most common. Setting tax rates appraising property worth and then receiving the tax.

Rates will vary and will be posted upon arrival. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. Box is strongly encouraged for all incoming mail.

Object moved to here. The Citys homestead exemption was increased to 10 percent of appraised value and the senior and disabled persons homestead exemptions were increased to 85000. Overall there are three phases to real estate taxation namely.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. Get Access To San Antonio Tax Records. South San Antonio ISD.

3 Tommy Calvert Pct. City of Alamo Heights. Maintenance Operations M O and Debt Service.

The property tax rate for the City of San Antonio consists of two components. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services. The Fiscal Year FY 2022 M O tax rate is 34677 cents per 100 of taxable value.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The FY 2022 Debt Service tax. This compares favorably with other parts of the state.

1 and Justin Rodriguez Pct. 4 and Bexar County Judge Nelson. San Antonio River Authority.

The process used. How San Antonio Real Estate Tax Works. The property tax rate for the City of San Antonio consists of two components.

Commissioners Rebeca Clay-Flores Pct. PersonDepartment PO Box 839966 San Antonio TX 78283-3966. The citys current tax rate which accounts for about 22 of property tax bills is nearly 056.

The states average effective rate is 242 of a homes value compared to the national average of 107. Florida gives real estate taxation rights to thousands of locally-based governmental units. Taxing entities include San Antonio county governments and a number.

City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office. For 2018 officials have set the tax rate at 34677 cents per. After much back-and-forth the new proposed property tax rate for Bexar County is now 0299999 per 100 valuation a reduction of just under 001098 cents.

City of San Antonio. In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261. Taxing Entity Officials List.

Every entity then is given the assessment amount it levied. If the city reduces its tax rate it would need the approval of council as it adopts is budget in September and it would take effect on Jan. City of San Antonio Print Mail Center Attn.

Throughout Bexar county of which San Antonio is the dominant player tax rates can vary between 12 and 14. Property Tax Rate Calculation Worksheets. The citys tax rate has been at nearly 056 since 2016.

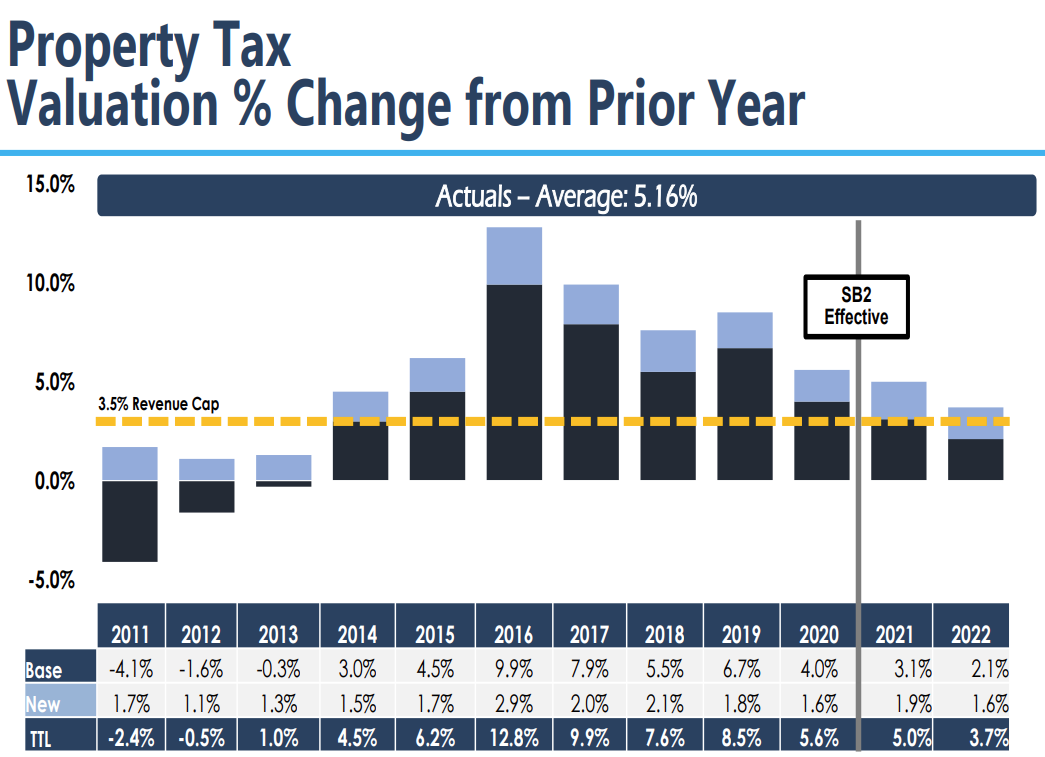

Tax bills in San Antonio typically increase because of climbing property values or school district rate increases. Alternatively the city could exceed the revenue cap but doing so would trigger an election asking voters permission to keep the additional tax revenue per the new law. Maintenance Operations MO and Debt Service.

San Antonio TX 78205. The tax rate varies from year to year depending on the countys needs. If the city reduces its tax rate it would need the approval of council as it adopts is budget in September and it would.

Mailing Address The Citys PO. PersonDepartment 100 W. City of San Antonio Attn.

Tax statements are then sent to all property owners. Still taxpayers most often get a single combined tax bill from the county. Monday - Friday 745 am - 430 pm Central Time.

SAN ANTONIO June 16 2022 Today the San Antonio City Council unanimously approved new property tax relief measures that will bring relief to taxpayers this fall. 211 South Flores Street San Antonio TX 78207 Phone. The FY 2022 Debt Service tax rate is.

Find Everything about Property tax bexar county and Start Saving Now. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. That includes the city school and municipal utility rate but does not include any special districts.

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide. Bexar Emergency District 6. San Antonio TX 78283-3966.

In a unanimous vote of the 10 members present Thursday morning San Antonio City Council approved raising the homestead exemption from the minimum 001 or 5000 up to 10 of a homes value. 33 rows San Antonio citiestowns property tax rates The following table provides 2017 the most common. Each unit then is given the tax it levied.

Hours Monday - Friday 745 am - 430 pm. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. Although Austin is smaller and encompasses a smaller number of areas for taxing its total tax rate on property can range between 12 and 15 as well.

Pin On Modcloth S Make It Work Contest

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

609 Spring St Dover Tn 37058 Dover Real Estate Sales Real Estate

Nar S New Webinar Series Focuses On Preventing Vacant Abandoned Properties Foreclosures Abandoned Property Distressed Property

Pin By Lng On Lng Pinterest 2016adjuly Private Mortgage Insurance Pay Off Mortgage Early Mortgage Tips

Why You Should Check Out Lowe S Provember Sale

2021 Housing Forecast In 2021 Real Estate Marketing Housing Market Real Estate Infographic

Pin En Moving To San Antonio What You Need To Know

Why It Makes Sense To Sell Your House This Holiday Season Selling Your House House Prices Homeowner

Pin On Real Estate First Time Home Buyer Programs Texas

Ask These 5 Questions Before Hiring A Real Estate Agent Rental Property Home Buying Rent To Own Homes

Homeownership Is A Key To Building Wealth Wealth Building Home Ownership Wealth

5 Tips For First Time Home Buyers Infographic First Time Home Buyers Real Estate Buyers Arizona Real Estate

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Rental Properties In The Us Infographic Portal Rental Property Real Estate Rentals Investment Property

Mortgage Rates Hit New 2014 Lows Property Tax Mortgage Rates Pay Off Mortgage Early