tax benefits of retiring in nevada

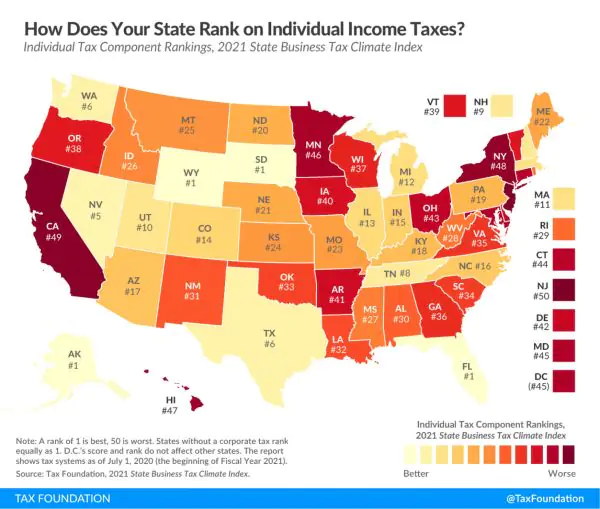

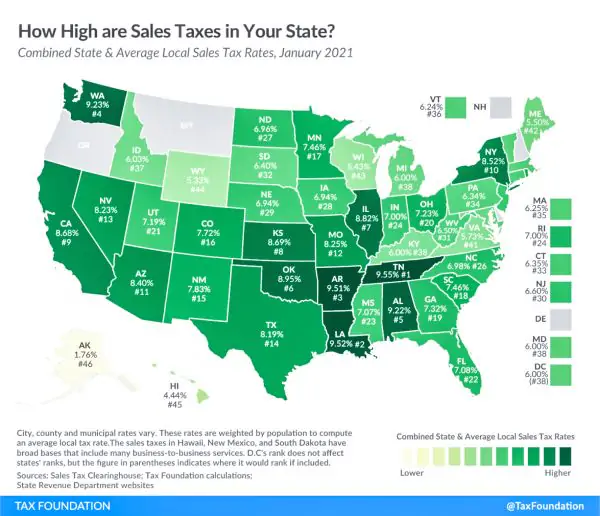

State sales tax is 685 but localities can increase that to 81. No personal income tax no state estate inheritance or gift tax lots of wide open spaces great entertainment and friendly people.

Nevada Tax Advantages And Benefits Retirebetternow Com

Youll Likely Pay Less in Taxes.

. At 83 Total tax burden in Nevada is 43rd highest in the US. Nevada has far more sunny days and lower humidity to enjoy them than most states. Gaming Food and Outdoors Las Vegas is full of things to do on and off the Strip.

How Much Do You Save in Retirement by Living in a State With Lower Taxes. Not to mention its a short flight or drive from California. In the top 10 of states according to data from NOAA.

No requirements of shareholders directors to live in Nevada. The state offers a myriad of recreational activities. If youre looking for a tax-friendly retirement Nevada is one of the places to be.

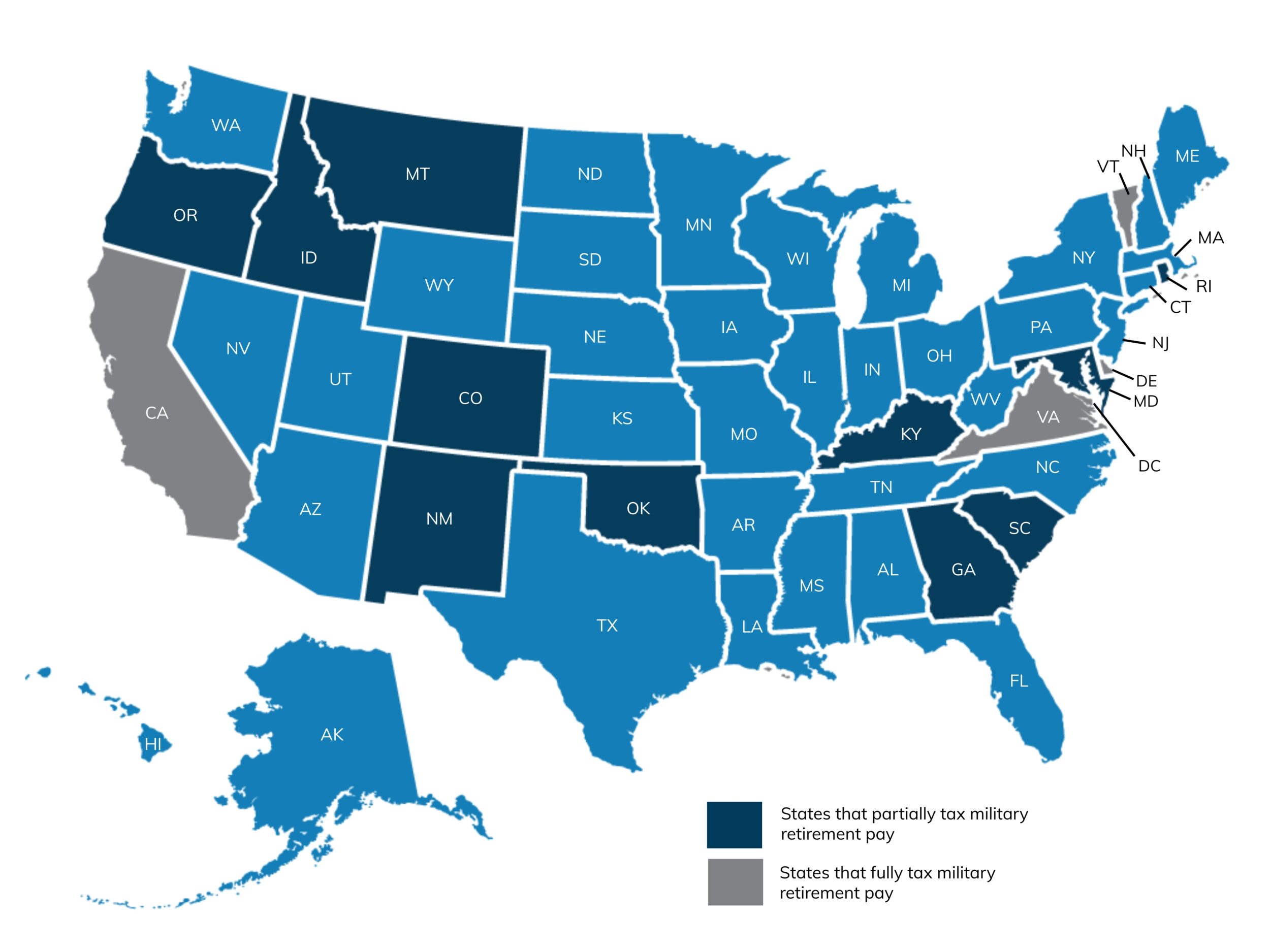

Nevada has no state income tax or inheritance tax making it the ideal state for someone who has a high income in retirement or a substantial 401 k or IRA that they will be forced to distribute at 705. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level. Is Nevada tax-friendly for retirees.

Nevada Tax Benefits Advantages -. In our 2016 analysis of the best states for retirement we ranked seven higher than Florida. No tax on sale or transfer of shares which keeps more cash in your pocket.

Cost of Living Both Arizona and Nevada have a meager cost of living compared with national averages. Hunting is a favorite pastime of many residents. In fact the state has no taxes on income or Social Security benefits.

Residency is single most important factor in gaining Nevadas tax advantages. Low Cost of Living. 76 of seniors who retire in Las Vegas report good health Lower cost of living No State Income Tax Social security income and retirement account income are not taxed.

Ranking factors included taxes cost of living and. All in one location. All of that savings adds up especially with home sales.

5 Good Reasons to Retire in Nevada 1. No succession or inheritance with IRS which keeps more cash in the pockets of your successors andor heirs. However you will pay state income taxes on withdrawals from qualified retirement accounts 401k IRA Thrift Savings Plan 403b etc.

Withdrawals from retirement accounts and public and private pension income are also not taxed whatsoever. Thanks to all of the tax revenue flowing to the state from the casinos and tourism Nevada currently offers residents of the state a low overall tax burden compared to most. Social Security and Retirement Exemptions.

Your 401 k withdrawals wont be taxed in Alaska Florida Illinois Mississippi Nevada New Hampshire Pennsylvania South Dakota Tennessee Texas Washington and Wyoming. They are not taxed. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

For taxed items the sales tax rate sits at 46 plus local taxes which can reach a total of 8265 at the highest. Ad Read this guide to learn ways to avoid running out of money in retirement. Cost of Living.

Hunting is a favorite pastime of many residents. Nevada offers an abundance of tax advantages for relocating home and business owners alike including. According to Sperlings Best Places the cost of living index in Nevada is 102.

In order to take advantage of Nevadas tax hospitality a taxpayer must make Nevada its principal place of residence ie. Local Casino promotions and specials such as Senior Days Communities offering golf recreation dining fitness etc. The lack of income tax is a huge benefit but wait.

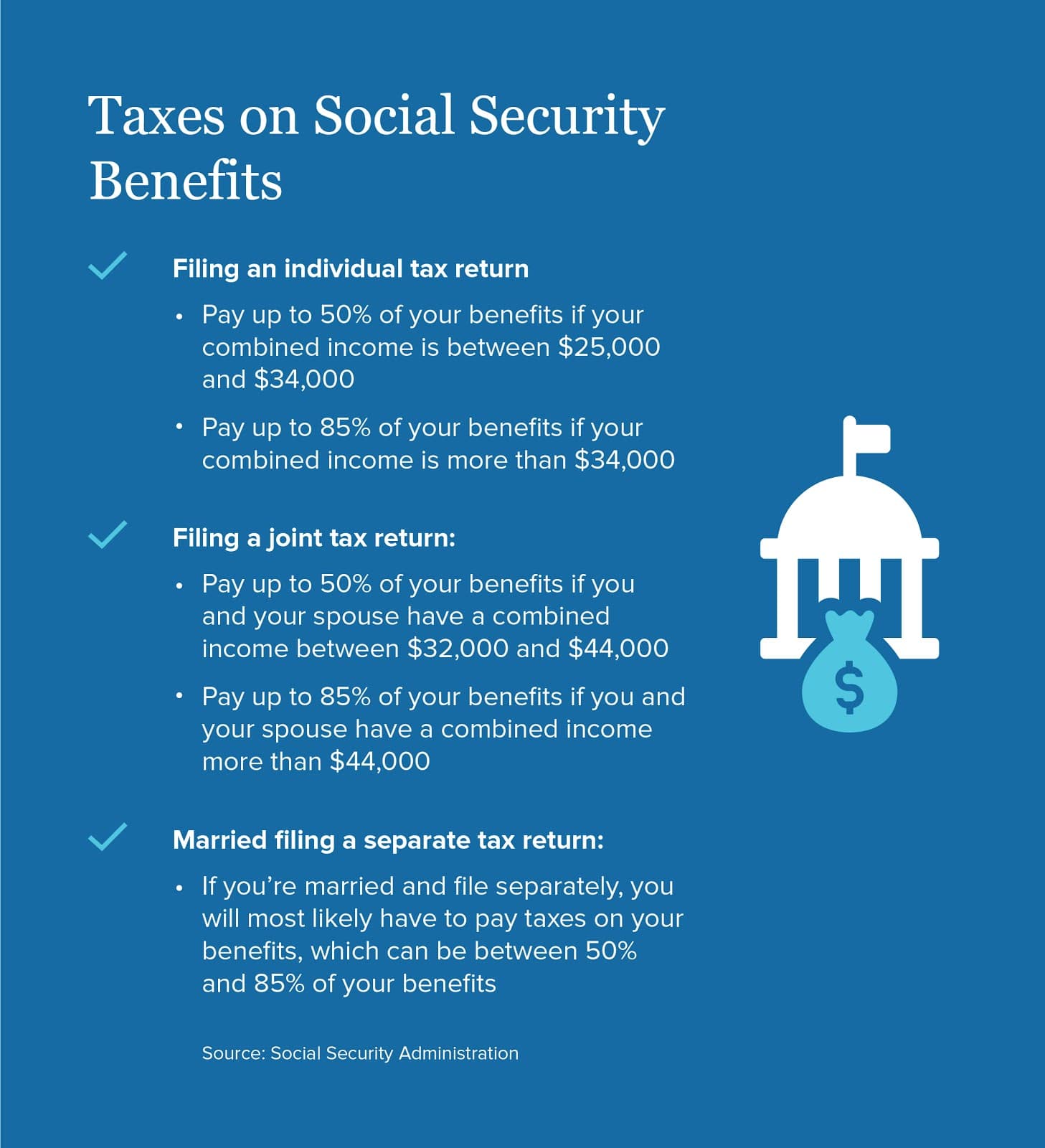

You must pay taxes on your benefits if you file a federal tax return as an individual and your combined income exceeds 25000. A close connection test is implemented and must be passed in order for a taxpayer to. According to Zillow the median home value in Nevada is 291800 While that may still.

Nevada has no income tax. Nevadans also dont pay sales tax on home sales food medicine and other items. Additionally the average effective property tax rate in Nevada is just 053.

Residents of Nevada are not assessed a state income tax. Nevada has warm weather desert air beautiful golf courses world-class spas outdoor activities affordable housing and no state tax and no inheritance tax. Considering the national average is 100 retirement here is going to cost more than some other states.

People who live in Nevada typically pay more for groceries healthcare and transportation than the average consumer. Nevada is extremely tax-friendly for retirees. Nevada is a low-tax paradise.

No tax on issuance of corporate shares keeps more cash in your pocket. The states that dont tax pension plans extend those same benefits to retirees with 401 k plans. For income that is taxed the lowest Hawaii tax rate is 14 on taxable income up to 4800 for joint.

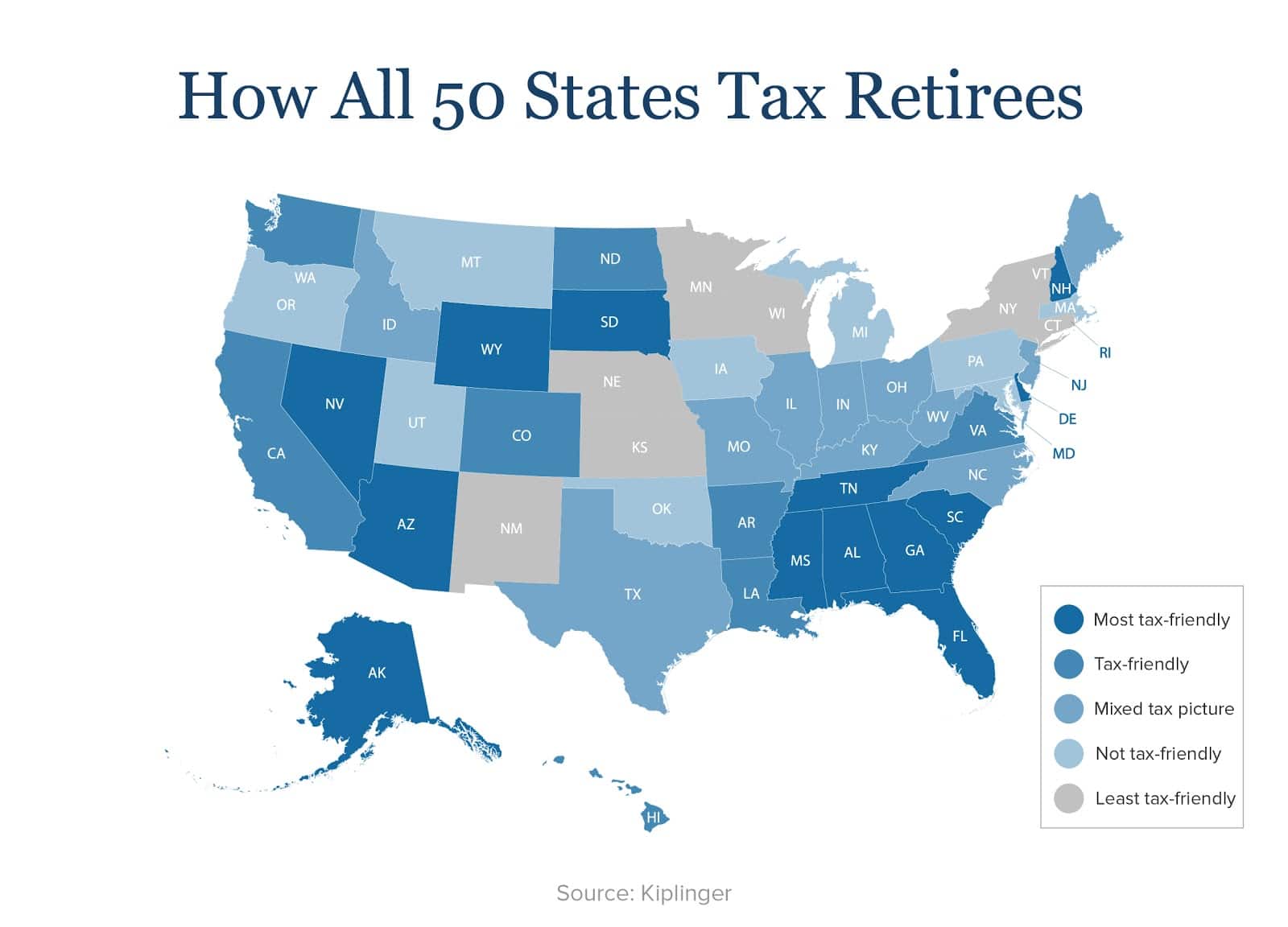

The reason for this ranking is the higher cost of health care and cost of living. Kiplinger ranked Nevada the 25th best state for retirees. Benefits of Retiring in Nevada 1.

This includes income from both Social Security and retirement accounts. And residents over the age of 62 who qualify can receive a rebate of up to 90 percent of their property taxes each year. The current state sales tax is 685 percent with.

Benefits of Retiring in Nevada 1. Not only does Nevada have relaxed gambling laws but also some of the best tax benefits for retirees. The obvious standout is the citys famous casino culture but seniors can also enjoy outdoor activities suited to Nevadas sunny weather.

Marginal Income Tax Rates. No personal income tax No corporate income tax No gross receipts tax No franchise tax No inventory tax No tax on issuance of corporate shares No requirements of shareholders directors to live in Nevada No tax on sale or transfer of shares.

Here S Why The Last 5 Years Before Retirement Are So Critical Financial Planner Millennial Money Emergency Fund

Retiring These States Won T Tax Your Distributions

Retiring These States Won T Tax Your Distributions

13 States That Can Tax Your Social Security Benefits The Motley Fool

How To Plan For Taxes In Retirement Goodlife Home Loans

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Nevada Retirement Tax Friendliness Smartasset

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

Hotel Pools In Las Vegas In 2021 Las Vegas Hotel Pool Daylight Savings Time

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

How To Plan For Taxes In Retirement Goodlife Home Loans

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

How To Plan For Taxes In Retirement Goodlife Home Loans

How To Plan For Taxes In Retirement Goodlife Home Loans

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Here Are The 11 Best Islands In The World To Enjoy Retirement Cnbc Retirement Island Enjoyment